Early 2023 U.S. Residential Solar Trends Report Finds Aurora Customers Created 40% More Solar Projects Year Over Year Amid Strong Demand Indicators

Aurora Solar, a cloud-based platform creating a future of solar for all by powering industry professionals to make solar simple and predictable, today announced its first “Solar Industry Snapshot.” This report examines early 2023 residential solar trends through three unique data studies: Aurora’s solar projects database of more than six million projects over the past two years; a survey of 1,000 U.S. homeowners about their solar adoption behaviors and motivations; and, a pulse check on the state of the industry through the lens of 898 U.S. solar professionals.

Key trends include:

Residential Solar Interest in Early 2023: While it will take years to fully realize the Inflation Reduction Act’s (IRA) potential, over 85 percent of residential solar professionals expect it to have a positive impact on their business — or have already seen that positive impact. Additionally:

- Nearly 77 percent of homeowners either have solar or are interested in purchasing it;

- Over the past year, more than nine in ten residential solar professionals saw increased interest in solar, and 70 percent noted their business grew in size; and,

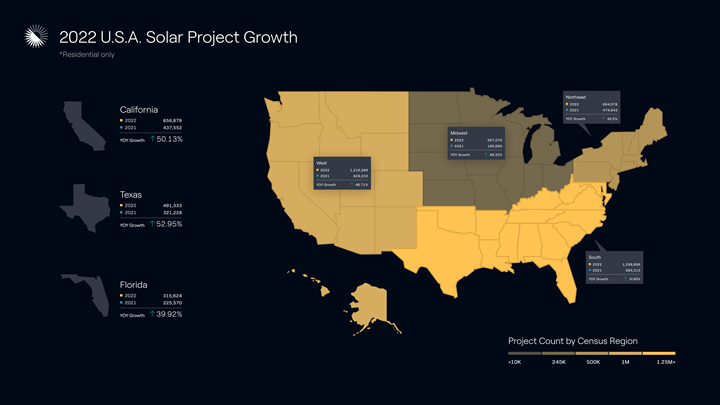

- U.S. solar project counts within Aurora grew by almost 40 percent year over year.

Homeowners and Energy Resilience: With concerns growing around energy costs and grid reliability, the solar conversation is heating up — along with the appeal of storage, electric vehicles, and more:

- 62 percent of homeowners expect energy prices will continue to rise;

- Homeowners have concerns around power outages stemming from weather events (48 percent), followed closely by cyber attacks on the power grid (46 percent);

- 82 percent of solar professionals noticed increased interest in battery storage from homeowners; and,

- 79 percent of solar professionals noted electric vehicle adoption is leading to interest in solar.

Supporting Homeowners Through Solar Education: Solar installation costs are a top concern among homeowners (56 percent), as well as uncertainty around whether their home receives enough sun exposure (31 percent). Other notable homeowner concerns included:

- 50 percent of homeowners feel it is difficult to determine if an installer is legitimate;

- 49 percent of homeowners think having a self-service portal for modeling their home’s energy savings is important for installers; and,

- 48 percent of homeowners want installers to offer multiple financing options.

For all of the insights from the Aurora Solar Industry Snapshot: Early 2023 U.S. Residential Trends, see here.

About Aurora Solar

Aurora is creating a future of solar for all. The company is putting the power of data and technology into the hands of every solar professional to make solar adoption simple and predictable. The cloud-based platform uses data, automation, and AI to help solar businesses streamline workflows and grow faster. More than 7,000 of the industry's top organizations rely on Aurora and over 10 million solar projects have been designed with the platform globally. The San Francisco-based company was the only climate tech business named to the 2022 Forbes AI 50, was listed on the 2022 Deloitte Fast 500, and voted the best solar software by Solar Power World in 2021. For more information, visit www.aurorasolar.com and follow on Twitter @AuroraSolarInc.

Comments (0)

This post does not have any comments. Be the first to leave a comment below.

Featured Product