IDTechEx Discusses Developments in Long Duration Energy Storage Technologies

As the volume of variable renewable energy (VRE) sources penetrating electricity grids increases globally, so does the need to manage the increasing uncertainty and variability in electricity supply. Long duration energy storage (LDES) technologies will be needed in key regions from the 2030s to support electricity grids with greater penetrations of VRE. From IDTechEx's new market report 'Long Duration Energy Storage Market 2024-2044: Technologies, Players, Forecasts', 1.4 TWh of LDES will be installed globally in 2044. It is expected that while mechanical energy storage systems are to be a key contributor to LDES deployments globally, a greater diversification of LDES technologies will be seen in the 2040s.

What LDES technologies are being developed?

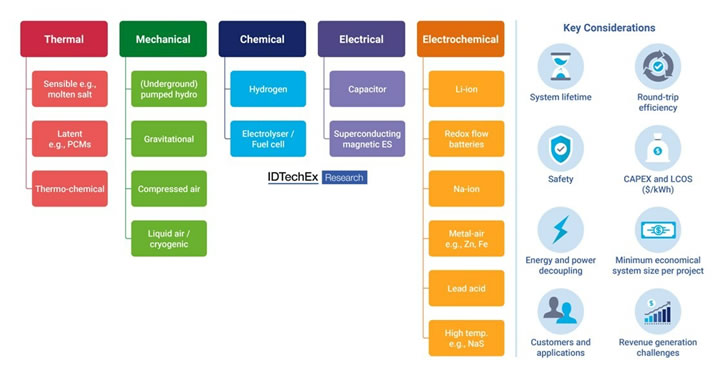

A variety of LDES technologies are currently being developed and commercialized across key regions. These technologies can be classified as electrochemical, mechanical, thermal, and hydrogen storage. Funding from private, public, and government sectors has seen ~US$4.0B invested into players developing these technologies (excluding hydrogen).

Many of these technologies are likely to be cheaper than Li-ion batteries on a $/kWh basis, potentially due to the use of cheaper materials and other designs that allow for energy and power decoupling. The independent scaling of energy capacity would see systems such as redox flow batteries (RFB), liquid-air, compressed-air, and underground pumped hydro storage, and some zinc battery designs benefit from reduced CAPEX (on a $/kWh basis) at longer durations of storage. For example, In the case of liquid-air energy storage (LAES), liquid-air storage tanks could be scaled, while turbomachinery would only need to scale with power output. As VRE penetration increases, longer average durations of storage will be needed in key regions. Therefore, by the 2030s, it is likely that the cost of commercial-scale LDES technologies will be reduced, demonstrating their advantage over Li-ion batteries.

Which LDES technologies will prevail in the market?

While, due to the current lack of commercial-scale deployments, it is difficult to pinpoint which technologies will be most economical to deploy, factors such as round-trip efficiency (RTE), cycle-life / lifetime, and energy density will also be key factors that influence the success of these technologies. IDTechEx benchmarks over 10 LDES technologies against these metrics in their market report, 'Long Duration Energy Storage Market 2024-2044: Technologies, Players, Forecasts'. In the long term, mechanical energy storage systems are likely to be a key contributor to LDES, given that these systems have become more economical to deploy at 100+ MW and have longer durations of storage. In the cases of LAES, liquid-carbon dioxide energy storage (LCES), and underground pumped hydro storage, it is possible to expand the capacity and, thus, duration of storage of such systems after initial commissioning, presenting another advantage. Moreover, some developers are already looking to deploy GWh-scale mechanical energy storage systems by 2030.

Other systems that will make up increasing market share in the 2040s include iron-air (Fe-air) batteries, rechargeable zinc batteries (e.g., Zn-air, static Zn-Br), RFBs, thermal and electro-thermal energy storage. Key alternative battery storage players include Form Energy, developing iron-air systems for 100 hours duration of storage, and developers of Zn-air batteries, including Zinc8 Energy and e-Zinc. These players are mostly in the pilot or early commercial stages of development. These technologies will benefit from the use of low-cost materials, although the lower RTEs (40-60%) of these technologies may also see them used for lower throughput applications such as backup power. Otherwise, these technologies will be reliant on reaching very low capital costs and/or require significant levels of renewable penetration to be suitable for LDES applications.

Thermal energy storage (TES) is already used for applications such as pairing with concentrated solar thermal (CSP) district heating, cold chain, and space heating in buildings. However, a growing proportion of TES systems are likely to be used more so by industrial companies to decarbonize their heat production processes, which have traditionally relied on burning natural gas. This will help minimize any penalties for releasing GHG emissions above a given cap. Key players developing TES technologies include Electrified Thermal Solutions, Kyoto Group, Rondo Energy, and Brenmiller Energy, to name a few. TES has a higher RTE for heat/electricity-to-heat than for heat/electricity-to-electricity (~95% vs. 40-60%) due to the conversion losses of heat to electricity with a turbine and generator on discharge, and so most of these systems will look to supply heat rather than electricity. Therefore, it is less likely these systems will be deployed to the same scale as other technologies for LDES applications. However, TES could also be used in CAES and LAES designs rather than using natural gas to provide heat of expansion for air during discharge. In an interview with IDTechEx, a developer of LAES systems commented that residual heat from TES could be used to also supply heating to district heating networks, rather than being vented, and where temperature requirements are much lower (100-140°C) than for providing heat of air expansion. This could increase LAES system RTE from 55% to 70%. Ultimately, while TES will be key in decarbonizing industrial heating processes, some systems could still be used for LDES applications or act as enabling technologies to improve the RTE of CAES and LAES systems.

Barriers and outlook for LDES technology deployment

A key barrier for more wide-scale implementation of LDES technologies is the need for longer-term revenue visibility. As LDES systems are mostly going to be 100 MWh-to-GWh-scale systems, the value of these systems could be in the range of US$100M-1B+. Current wholesale electricity price arbitrage opportunities alone are generally not long or large enough to make a strong economic case for the widespread deployment of LDES in the current day. LDES developers will be looking to secure capacity market contracts to secure long-term and high volumes of annual revenue, but this alone is unlikely to cover most of the investment into an LDES technology. Ultimately, key players in an interview with IDTechEx commented that regulatory reforms to revenue generation from energy storage are needed to improve the economic case for LDES technologies and to improve investor confidence. Ultimately, however, and depending on VRE penetration, it will not be until the mid-2030s when demand for LDES technologies starts to accelerate in key regions, with wider demand globally only coming by ~2040.

For more information on LDES technologies, players, applications, revenue streams, electricity markets, variable renewable energy (VRE) penetration, grid stability and flexibility, and granular 20-year market forecasts, please refer to IDTechEx's market report, 'Long Duration Energy Storage Market 2024-2044: Technologies, Players, Forecasts'.

For more information on this report, including downloadable sample pages, please visit www.IDTechEx.com/LDES or for the full portfolio of Energy Storage research available from IDTechEx please visit www.IDTechEx.com/EnergyStorage.

About IDTechEx

IDTechEx provides trusted independent research on emerging technologies and their markets. Since 1999, we have been helping our clients to understand new technologies, their supply chains, market requirements, opportunities and forecasts. For more information, contact research@IDTechEx.com or visit www.IDTechEx.com.

Comments (0)

This post does not have any comments. Be the first to leave a comment below.

Featured Product