Forecast: Solar Tax Credit Extension Would Boost Jobs, Economy and Climate Fight

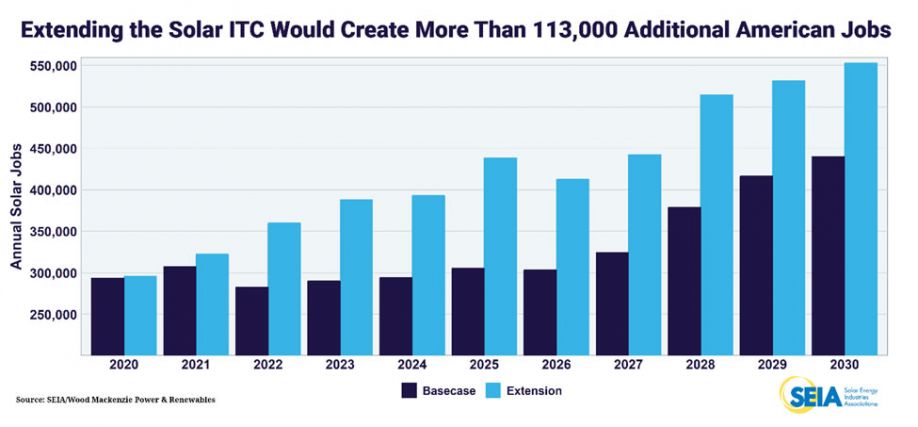

SALT LAKE CITY – An extension of the solar Investment Tax Credit (ITC) would spark $87 billion in new private sector investment and add 113,000 American jobs over baseline estimates by 2030, according to 10-year forecasts released today by the Solar Energy Industries Association (SEIA) and Wood Mackenzie Power & Renewables.

The forecasts come as SEIA ramps up its efforts to secure an extension of the ITC in Congress, and as nearly 20,000 solar and storage professionals descend on Salt Lake City for Solar Power International.

“These forecasts prove that an ITC extension will continue to deliver real results for our economy and the planet,” said Abigail Ross Hopper, president and CEO of the Solar Energy Industries Association. “The ITC has helped us add billions to the economy, employ thousands of Americans, and be a real solution for cities and businesses that want to do their part to reduce emissions. We’re telling members of Congress to take this climate win now. You don’t have to wait for a comprehensive solution to take action on our energy future.”

Key Forecast Data:

- With an ITC extension, annual investment in solar would reach $41 billion by 2030, more than 141% greater than the $17 billion invested in 2018.

- An ITC extension would offset an additional 363 million metric tons of CO2 emissions over the next 10 years, equivalent to 21% of all emissions from U.S. electricity generation in 2018.

- By 2030, annual offsets will be equivalent to taking 77 million cars off the road or eliminating the emissions from 93 coal plants.

- The 82 GW of additional capacity spurred from an ITC extension is enough to power more than 15 million American homes.

Wood Mackenzie Power & Renewables developed the capacity forecasts while SEIA extrapolated on this data to develop additional analysis.

“The utility-scale segment will see the greatest benefit of the tax credit extension, with 63 of the 82 additional GW coming from that segment, as solar will gain ground against other generation resources based on price competitiveness,” said Colin Smith, senior analyst with Wood Mackenzie. Austin Perea, Wood Mackenzie senior analyst added, “the distributed solar segment will benefit as well, as a tax credit extension accelerates the timeline for which emerging state markets achieve grid parity relative to our base case outlook.”

Since its implementation in 2006, the ITC has helped create more than 200,000 American jobs, added $140 billion in private sector investment and grown solar deployment by 10,000%.

The solar ITC is currently scheduled to begin stepping down at the end of this year, with the commercial system credit dropping to a permanent 10% in 2022, and the residential system credit phasing out entirely.

Read the 2019 Solar ITC Impact Analysis report: www.seia.org/ITCimpacts.

Learn more about SEIA’s campaign to extend the solar Investment Tax Credit at www.seia.org/DefendTheITC.

###

About SEIA®:

Celebrating its 45th anniversary in 2019, the Solar Energy Industries Association® is the national trade association of the U.S. solar energy industry, which now employs more than 242,000 Americans. Through advocacy and education, SEIA® is building a strong solar industry to power America. SEIA works with its 1,000 member companies to build jobs and diversity, champion the use of cost-competitive solar in America, remove market barriers and educate the public on the benefits of solar energy. Visit SEIA online at www.seia.org.

Comments (0)

This post does not have any comments. Be the first to leave a comment below.

Featured Product