US Solar Market Adds 2.5 GW of PV in Q1 2018, Growing 13% Year-Over-Year

|

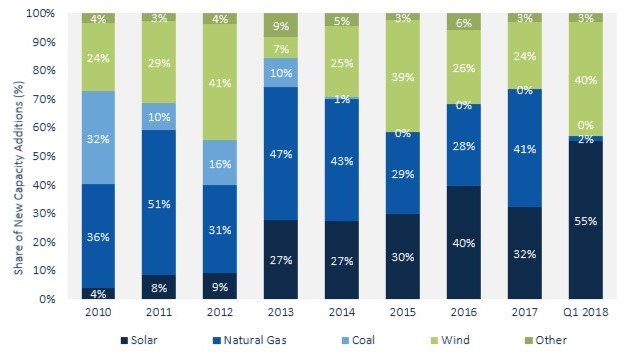

BOSTON, Mass. and WASHINGTON, D.C. - Showing resiliency in spite of the new tariffs on imported modules, the U.S. solar market added 2.5 gigawatts of solar PV in the first quarter of the year, representing annual growth of 13 percent, according to the latest U.S. Solar Market Insight Report from GTM Research and the Solar Energy Industries Association (SEIA).

Download the report’s free executive summary here. |

|

About U.S. Solar Market Insight: The U.S. Solar Market Insight report is the most detailed and timely research available on the continuing growth and opportunity in the U.S. The report includes deep analysis of solar markets, technologies and pricing, identifying the key metrics that will help solar decision-makers navigate the market's current and forecasted trajectory. For more information, visit www.greentechmedia.com/research/ussmi |

Comments (0)

This post does not have any comments. Be the first to leave a comment below.

Featured Product