Who is the Largest Investor in Renewable Energy?

In 2022 chinese investment in clean energy is the highest worldwide. China pumped more than 90 billion USD into clean energy research and development.

The US and Japan had the second and third-highest clean energy investments that year, at 58.9 billion and 17.90 billion USD, respectively. All selected countries combined had spent 220.23 billion USD on alternative energy technologies. The leading three entries accounted for roughly 72.4 percent of total investments.

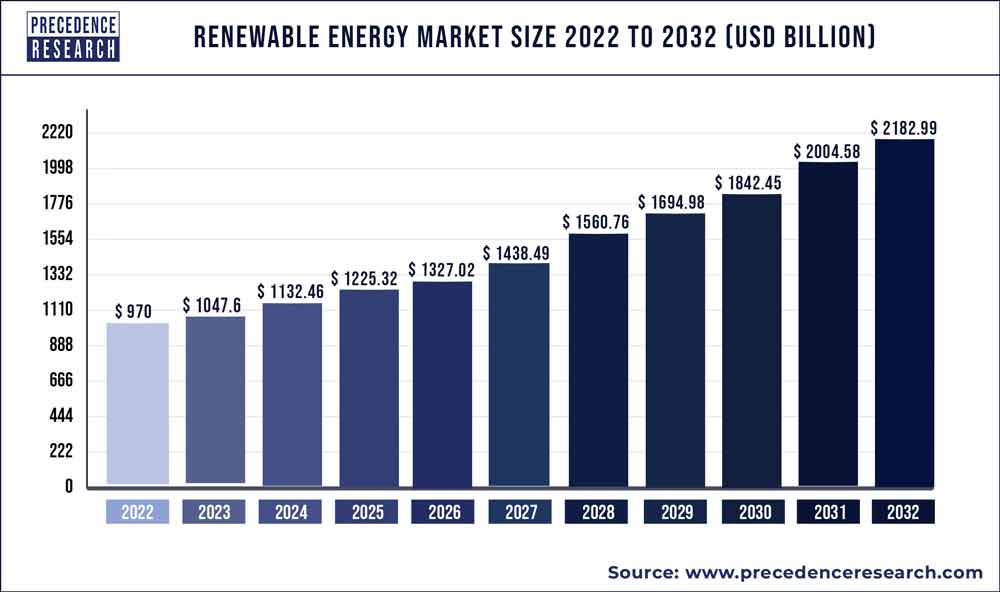

According to Precedence Research, the global renewable energy market size is expected to cross around US$ 1,998.03 billion by 2030 from US$ 1.030.95 billion in 2022, growing at a CAGR of 8.6% from 2022 to 2030.

The rising government and corporate investments towards the adoption and deployment of the renewable energy sources in the industrial and commercial sectors is driving the growth of the renewable energy market. The government across the developed and developing economies is undergoing several regulatory changes and is offering subsidies to the corporate sector to adopt the renewable energy. The rising technological advancements are fueling the demand for the renewable energy sources as the costs of the renewable energy are declining.

With the rising investments in the industrialization and urbanization, the demand for the sustainable energy is growing significantly across the globe. The growing concerns related to the climate change and increasing pollution levels is driving the adoption of the renewable energy. At present, around 7% of the energy consumed is renewable energy across the globe. With rising investments in the solar, wind, and hydroelectric power infrastructure, the demand for the renewable energy is expected to foresee a burgeoning growth in the forthcoming future.

What is the target of renewable energy by 2022?

India has so far installed 66% of its targeted renewable energy installation of 175 GW with only Gujarat, Rajasthan, Karnataka and Telangana meeting State-wise targets, according to a report on Thursday by global energy thinktank Ember.

Four States account for the majority, or about 60% of the shortfall, namely Maharashtra, Uttar Pradesh, Andhra Pradesh, and Madhya Pradesh. The trend, however, say analysts involved with the report, is of an acceleration in solar installations. The first eight months of this year saw a 22% rise in installations compared to the previous eight months of last year.

Solar structures represented 89% of new renewable capacity installations this year. Wind installations only rose by 7% compared to last year and comprised 10% of all new renewables (RE) installations so far this year. Overall, renewable installations also slowed considerably from April 2022, in part due to an increase in the basic customs duty. By July 2022 India saw the lowest level of new installations since June 2020, before picking up in August. The customs duty was hiked to discourage reliance on foreign-made raw material.

The Centre this week cleared a ₹19,500-crore incentive scheme to encourage end-to-end domestic manufacturing of solar panels.

While India may not reach 175 GW by the end of 2022, its 2030 targets of 450 GW renewables and 500 GW non-fossil capacity - set as part of its nationally determined contribution to meeting its international climate targets - are within reach, the report notes.

This, however, would require key States to seize the opportunity and address the barriers to renewables uptake to accelerate their renewables deployment and contribute to the success of national clean energy transition. "India's solar rush earlier this year shows how quickly change can come. It has even led to a record renewable energy capacity addition of 3.5 GW in March this year. In order for India to achieve its ambitious 2030 RE and non-fossil capacity targets, the country needs to consistently hit this all-time record set in March," Aditya Lolla, senior electricity policy analyst, Ember, said in a statement.

What are the market dynamics of the Renewable Energy Market?

Driver: Declining costs of the solar energy to foster market growth

It has been observed that there has been a decline of around 85% in the costs of the solar power in the past decade and the solar photovoltaic system has become one of the cost competitive resources. The solar-storage buildout, floating solar PV models, and community solar projects are anticipated to be the key trends in the emerging markets. The development of the storage for solar energies will help in improving the operational efficiencies and control costs. Furthermore, the expansion of the community solar projects in the developed markets like US is expected to significantly drive the growth of the renewable energy market during the forecast period.

Restraint: High capital investments

The development of new resource involves huge capital investments towards building new infrastructure. The high capital requirements ultimately increase the costs of the electricity from the renewable sources. Therefore, the high initial capital investments and lack of resources in several countries is playing a major role in hindering the growth of the renewable energy market.

Opportunity: Advancement in the technologies to reduce the cost

The increasing investments in the research and development and the techno logical advancements play a significant role in reducing the costs of the electricity from the renewable energy sources. The rising adoption of the grid technology is facilitating in reducing the costs, which is expected to foster the adoption of the renewable energy sources during the forecast period.

Challenge: Unfavorable climatic conditions in several countries

The climatic conditions are cold in several developed countries of North America and Europe. Due to this there is a lack of adequate sunlight that hinders the adoption of the solar energy and solar panels in the residential sector. This is a major challenge faced by the market players and the consumers.

Declining costs of the solar energy to foster market growth

It has been observed that there has been a decline of around 85% in the costs of the solar power in the past decade and the solar photovoltaic system has become one of the cost competitive resources. The solar-storage buildout, floating solar PV models, and community solar projects are anticipated to be the key trends in the emerging markets. The development of the storage for solar energies will help in improving the operational efficiencies and control costs. Furthermore, the expansion of the community solar projects in the developed markets like US is expected to significantly drive the growth of the renewable energy market during the forecast period.

High capital investments

The development of new resource involves huge capital investments towards building new infrastructure. The high capital requirements ultimately increase the costs of the electricity from the renewable sources. Therefore, the high initial capital investments and lack of resources in several countries is playing a major role in hindering the growth of the renewable energy market.

Declining costs of the solar energy to foster market growth

It has been observed that there has been a decline of around 85% in the costs of the solar power in the past decade and the solar photovoltaic system has become one of the cost competitive resources. The solar-storage buildout, floating solar PV models, and community solar projects are anticipated to be the key trends in the emerging markets. The development of the storage for solar energies will help in improving the operational efficiencies and control costs. Furthermore, the expansion of the community solar projects in the developed markets like US is expected to significantly drive the growth of the renewable energy market during the forecast period.

High capital investments

The development of new resource involves huge capital investments towards building new infrastructure. The high capital requirements ultimately increase the costs of the electricity from the renewable sources. Therefore, the high initial capital investments and lack of resources in several countries is playing a major role in hindering the growth of the renewable energy market.

Featured Product

HPS EnduraCoilTM Cast Resin Medium Voltage Transformer

HPS EnduraCoil is a high-performance cast resin transformer designed for many demanding and diverse applications while minimizing both installation and maintenance costs. Coils are formed with mineral-filled epoxy, reinforced with fiberglass and cast to provide complete void-free resin impregnation throughout the entire insulation system. HPS EnduraCoil complies with the new NRCan 2019 and DOE 2016 efficiency regulations and is approved by both UL and CSA standards. It is also seismic qualified per IBC 2012/ASCE 7-10/CBC 2013. Cast resin transformers are self-extinguishing in the unlikely event of fire, environmentally friendly and offer greater resistance to short circuits. HPS also offers wide range of accessories for transformer protection and monitoring requirements.