The Emerging Relationship between Distributed Energy Resources and the Transmission System

Allison Clements | NRDC

THE TRANSMISSION SYSTEM AND UTILITY BUSINESS MODEL REFORM: Avoiding road blocks

This article is the fifth and final in a series on the policy relationship between distributed energy resources or “DERs” (energy efficiency, demand response, rooftop solar, electric vehicles and other storage and other customer-driven resources) and the high-voltage transmission system.

With New York and California leading the way, we are on the precipice of rapid change in the way distribution systems operate and the role that utilities play in that operation. Although the opportunity may be more immediate in restructured states, governors, legislatures and utility commissions in states with retail competition and vertically integrated states are increasingly interested in fighting climate change and strengthening grid resilience in response to events like Hurricanes Katrina and Sandy. Market forces and customer interest are bringing down the price of rooftop solar and other DER technology. States are proactively or by necessity considering a reformed role for utilities in which all sorts of DER providers either compete or contract to provide energy, rate designs incent efficient behavior, and utilities remain responsible for energy delivery. Mounds of important reports, analyses and in the case of New York and California, action exist about DERs and the changing role of utilities.

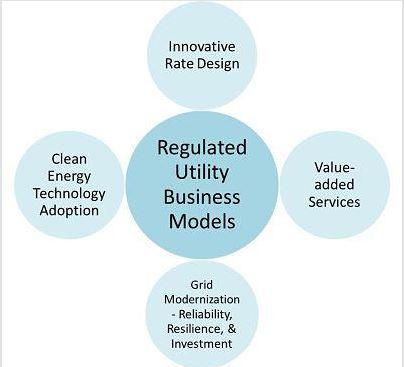

LBNL's diagram of utility business reform categories.

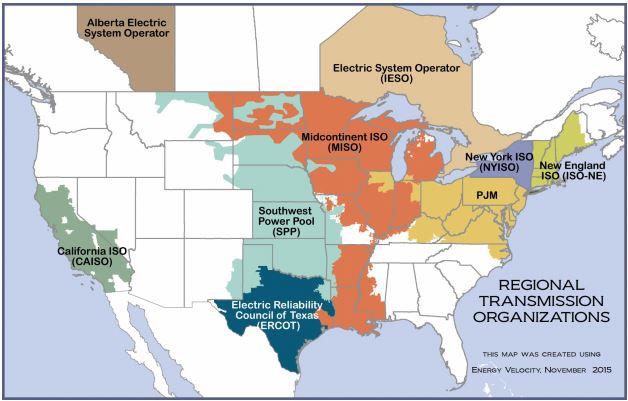

Although much of the relevant change will take place on the distribution system, the Federal Energy Regulatory Commission, transmission-owning utilities, regional transmission organizations and independent system operators have the opportunity to facilitate (or obstruct) this transition and, in any case, will feel and need to adjust for its impacts.

How does the transmission system relate to utility business model and retail regulatory reform?

In light of the increasingly integrated grid described throughout this series, the idea that the transmission system is not relevant to the facilitation of a changing utility model and distribution system is untenable. Parts 2 (regional load forecasting), 3 (transmission system planning) and 4 (wholesale markets) of this blog series demonstrate ways in which DERs that exist on the distribution system implicate and have the potential to add value to the development and operations of the high voltage transmission system. In the reverse, transmission system operators have the opportunity to facilitate and add value to the retail reform happening on the distribution system. At least some of the categories in which this opportunity exists include price and use transparency, actual use settlements, and operational coordination.

The transmission grid operator for New York, known as NYISO, recently issued a “DERRoadmap” that focuses on the market and operations integration aspects of DERs and the bulk system. The promising document (which serves as a great model for other regional transmission grid operators across the country) also addresses how to align wholesale markets and operations with the New York Public Service Commission’s Reforming the Energy Vision proceedings, intended to transform retail regulation to empower customers, increase DER use, and make the utility into the system operator and electricity delivery agent. The considerations in the DER roadmap provide a strong real-life example of addressing the considerations described below (along with several others).

Price and use transparency

Two aspects of price transparency are necessary for wholesale market operators and transmission-owning utilities to enable retail utilities and other DER providers to design programs and incentives to encourage DER adoption, support efficient retail rate design, and aid in distributed solar and other DER valuation efforts.

First, wholesale prices are a key component of retail DER programs and innovative rate designs that comprise part of utility business model reform efforts. For example, utilities and other companies can implement price responsive demand programs in which customers are willing to cut back on electricity use when energy prices go above certain levels, or, dynamic pricing rate designs in which customers are exposed to higher rates during periods of high customer demand but can save money on their electricity bills by using more power during low-demand periods.

To make these programs and rate designs work, the utilities and third parties must have access to one key component that goes into retail rates – actual wholesale energy prices, in close to real time. Although day-ahead market prices correlate to some extent with real-time prices, changes occur throughout the day that cause variation in real-time prices from what was predicted the day before. In a report for the Sustainable FERC Project, energy policy expert Paul Centolella explains that regional wholesale market operators generally predict real-time prices at least a few hours in advance throughout the day for their own operating purposes. Unfortunately, most of these regions, which are regulated by the Federal Energy Regulatory Commission, do not make the near-term predictions public (ERCOT, the regional grid operator in Texas, is a notable exception). The resulting lack of transparency in regions regulated by the Federal Energy Regulatory Commission (FERC) creates a barrier to innovation at the retail level that states do not have the authority to fix.

Although I'd probably use a wind farm instead of a nuclear power plant, PJM's picture is a good depiction of the relationship between wholesale and retail markets.

https://learn.pjm.com/electricity-basics/market-for-electricity.aspx

Second, as part of reforming distribution system regulation and operations, DERs need pricing signals that allow for locational valuation. DERs that interconnect to the distribution system have more or less value (and may impose costs) based on where they interconnect to the system. “Value of solar” proceedings in states around the country like Minnesota and New York are attempting to get at locational value of DERs – to say the efforts are complicated is an understatement. Regional wholesale market operators typically provide prices at the zonal level (often, the zones equate to one or several utilities’ footprints). NYISO’s DER Roadmap recognizes that “to facilitate more economically efficient DER activity there is a need to expose DER to more granular price signals reflective of location specific system conditions.” The Roadmap states that NYISO will deliver sub-zonal pricing for purposes of DER participation in wholesale markets, but these more geography-specific prices will also facilitate development of retail-level price responsive demand and dynamic pricing programs and incentives.

Actual Use Settlements

Centolella’s report identifies another FERC-jurisdictional barrier to proper incentives for some retail DER-related programs – the failure by wholesale energy markets to settle buyer (i.e., wholesale customers like retail utilities) accounts more often than on the hourly basis that is current standard operating procedure. The flexibility services that DERs can provide to the grid, in the case of cloud coverage that mutes solar energy output or breaks in the wind that damp down wind energy output, for example, happen in the minute-to-minute timeframe, not on an hourly basis. To capture the value of shifts in intra-hour energy supply (and perhaps more importantly, customer demand), regional grid operators should be willing to settle more often than hourly. In addition, settlements should be made based on actual usage within the hour, and not on historic representative load determinations. Measuring actual wholesale customer use is relatively easy to do in areas that have deployed advanced metering infrastructure (AMI) into homes and businesses. In areas without AMI, settlements could be based on statistical sampling so that only limited AMI deployment would be necessary. Failure to change wholesale settlement practices is another way that FERC-jurisdictional practices act as a road block to innovative utility reform at the state-jurisdictional retail level.

Operational Awareness and Coordination

Some reform to utility business models in restructured states like New York (states in which companies other than the utilities compete to provide customers electricity), envision retail-level competitive markets for the provision of necessary grid services that operate similarly to the wholesale markets described in Part 4 of this series.

Imagine a situation in a restructured state that lives within an RTO where robust DER market opportunities exist at both the retail and wholesale level. This combination of markets ideally provides robust opportunities for DER providers to choose whether to participate in wholesale markets or retail markets. The grid operators at both levels must be aware of how DERs are being utilized at the other level, so that resources are not considered available to perform by the two different grid operators at the same time. The NYISO DER Roadmap describes it like this: “[S]everal operational, market and legal challenges [] must be addressed prior to allowing dual participation. An example of such a challenge is the resource potentially having multiple masters who send the dispatch/pricing signals that [] may or may not be coordinated, forcing the resource to choose which signal to follow.” Much is already being done to address these issues across regional grid operator regions, but more work remains.

What federal policy changes are necessary to facilitate these reforms?

1. FERC should use its authority to ensure just and reasonable rates and facilitate price transparency by requiring the regional transmission organizations and independent system operators to (i) publicize intra-day price predictions in a manner that facilitates retail dynamic pricing and price responsive demand programs and (ii) provide pricing information at the [load/bus bar] level (or some other meaningful sub-zonal level) to provide accurate pricing signals to DERs.

2. FERC should specify that wholesale customer settlements should, to the extent possible, represent actual usage of the wholesale customer’s retail customers. Settlements should also occur on an intra-hour basis to provide meaningful differentials in price signals.

3. FERC should mandate or encourage cooperation between retail utilities and wholesale grid operators to address operational awareness and coordination in a manner that allows DERs to participate in either retail or wholesale-based market opportunities.

With these changes, FERC and the regional grid operators can facilitate and help lead the transformation utility business models and our distribution systems.

The content & opinions in this article are the author’s and do not necessarily represent the views of AltEnergyMag

Comments (0)

This post does not have any comments. Be the first to leave a comment below.

Featured Product