Overall, solar companies categorized as wafer/ingot producers experienced the strongest margin performance over the last year, while each sector exhibited certain levels of improvement.

Q2 2016 Deal Volume Comparison

Contributed by | Lincoln International

There were 20 completed solar energy transactions in Q2 2016, which represents a decrease from the 26 transactions recorded in in Q1 2016. On a comparative basis, this represents a decrease from the 25 transactions reported in Q2 2015.

Within the solar energy transactions, consolidation represented 70% of M&A activity, or 14 deals in Q2 2016. The next largest category was investment by private equity/investors with 3 transactions, or 15% of the deals in Q2 2016. There were two transactions categorized as vertical integration and one transaction categorized as diversification into the solar industry this quarter.

In Q2 2016, 45% or 9 of the 20 total transactions occurred in the U.S. and Canada. This represents a 7% increase in M&A activity in this geography from Q1 2016. Europe recorded 6 transactions, or 30% of the Q2 2016 total. Cross-continental deals accounted for three transactions, or 15% of the total in Q2 2016, while Asia recorded two transactions, or 10% of the Q2 2016 total. South America did not record a solar energy transaction this quarter.

In addition, there were 11 acquisitions of producers of solar energy (this category includes acquisitions of solar projects), or 55% of the total. There were 5 acquisitions of EPC integrators/developers, or 25% of the total transaction volume. Acquisitions of companies categorized as service providers for solar accounted for three transactions, or 15% of the Q2 2016 total. Acquisitions of solar companies categorized as balance of system providers accounted for one transaction, or 5% of the total in Q2 2016. There were no acquisitions of vertically integrated solar companies.

Consolidation for producers of solar power continued to be the primary source of deal activity, in addition to continued volume from the private equity/investors category.

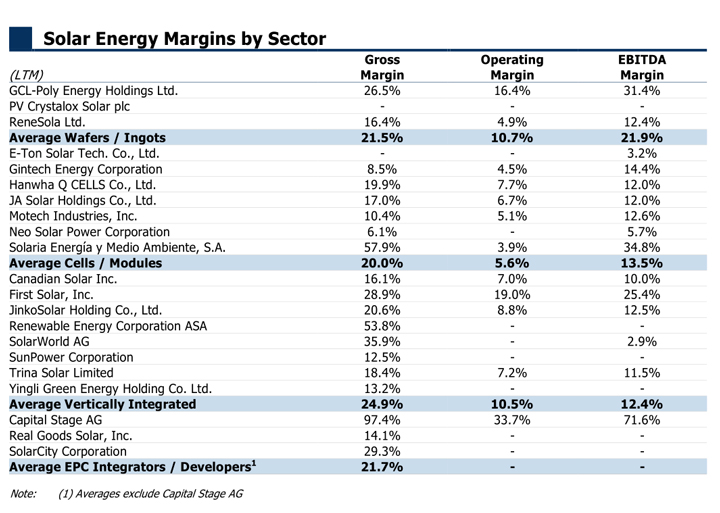

Margin Performance in the Solar Energy Industry

The majority of sectors within the solar energy industry are exhibiting stronger bottom line margins, as solar companies are benefitting from continued decreases in balance of system costs, industry consolidation and continued growth for solar in certain geographies. Additionally, the vertically integrated models are continuing to show benefits with consistent margin improvement.

The three graphs on the following page provide an overview of gross margin, operating income margin, and EBITDA margin performance from 2005 through today. Each graph shows the margin performance by sector within the solar energy industry.

In terms of margin performance by sector, wafers/ingots companies saw improvement in gross, operating and EBITDA margins in LTM Q2 2016. Vertically integrated companies saw declining gross margins, but improvement in operating and EBITDA margins compared to a year ago. The cells/modules companies saw increasing operating margins but declining gross and EBITDA margins during the LTM Q2 2016 period.

Overall, solar companies categorized as wafer/ingot producers experienced the strongest margin performance over the last year, while each sector exhibited certain levels of improvement.

About Lincoln International

Lincoln International specializes in merger and acquisition advisory services, debt advisory services, private capital raising and restructuring advice on mid-market transactions. Lincoln International also provides fairness opinions, valuations and pension advisory services on a wide range of transaction sizes. With sixteen offices in the Americas, Asia and Europe, Lincoln International has strong local knowledge and contacts in key global economies. The firm provides clients with senior-level attention, in-depth industry expertise and integrated resources. By being focused and independent, Lincoln International serves its clients without conflicts of interest. More information about Lincoln International can be obtained at www.lincolninternational.com.

The content & opinions in this article are the author’s and do not necessarily represent the views of AltEnergyMag

Comments (0)

This post does not have any comments. Be the first to leave a comment below.

Featured Product