2013 is expected to be another record year for new wind energy development in Canada with the largest portion of new projects being developed in Quebec and Ontario.

CANWEA 2013 - Wind Energy in Canada

Ariane Sabourin for | CANWEA

How much has wind energy grown in Canada?

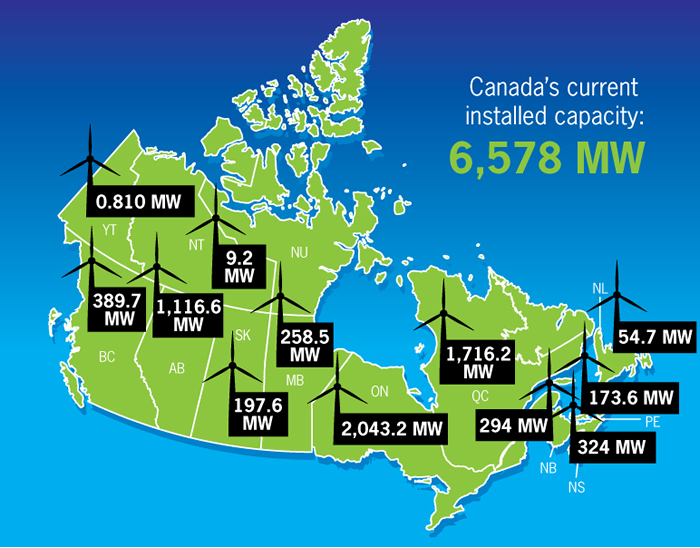

In 2012, wind energy grew by nearly 20 per cent in Canada, driving over $2 billion in investments and creating 10,500 person-years of employment. The industry in Canada installed 936 MW in 2012, bringing the total installed capacity to 6,200 MW by end of year.

Wind energy projects were built and commissioned in British Columbia, Alberta, Ontario, Manitoba, Northwest Territories, Quebec and Nova Scotia. Ontario is the provincial leader with over 2,000 MW of installed wind energy capacity, while Quebec wind farms made up about 46 per cent of total installations in Canada in 2012.

There were many firsts for wind energy in Canada in 2012. The 9.2 MW Diavik Wind Farm has not only put the Northwest Territories on Canada’s wind map, it has also opened the door to a potential new market in a growing mining sector looking to tap into the economic and environmental advantages wind energy brings. The 4 MW M'Chigeeng Mother Earth Renewable Energy Project in Ontario is the first wind farm 100 per cent owned by a First Nations community in Canada. These milestones highlight the diversity of the wind energy industry in Canada and its ability to deliver real economic and environmental benefits at a local level.

What are some of the obstacles and barriers to wind energy development in Canada?

One area where policy clarity is still required is in Canada’s approach to climate change. Securing a national carbon pricing framework in Canada that recognizes wind energy’s environmental attributes in market prices is critical to future wind energy development – particularly at a time when low-priced natural gas is factoring heavily into discussions about future electricity supply. The industry will have to continue to show that wind energy is an economically efficient and sensible investment from an electricity pricing perspective, both today and in the long term.

Further, many jurisdictions will be taking decisions on the future shape of the electricity mix in Canada over the next 18-24 months. What is uncertain at this time, however, is what role wind energy will ultimately play in these new long-term plans for electricity development that will soon be discussed and debated across Canada. The coming months will be crucial to assuring the sustainable growth of the country’s wind energy industry beyond 2015.

Continued political support and policy stability is crucial to ensure wind energy continues to deliver clean, safe and affordable power in all provinces.

Is the Canadian Government a co-operative partner in the deployment of wind energy or are the regulations a net burden to development?

2011 marked the end of the federal government’s ecoEnergy for Renewable Power program. While this program was critical to stimulating the first phase of Canada’s wind energy development, the federal government has now clearly backed away and signaled that the next phase of wind energy development in Canada will need to rely on political leadership from provincial governments.

What is the outlook for the Canadian wind industry in 2013 and beyond?

2013 is expected to be another record year for new wind energy development in Canada with the largest portion of new projects being developed in Quebec and Ontario. New contracts were also awarded in 2012 for projects in Saskatchewan, Nova Scotia and Prince Edward Island. With various projects now contracted to be built across Canada, the country will see on average 1,500 MW of new wind energy installations commissioned annually for the next few years.

Canada is expected to reach 12,000 MW of total installed capacity by 2016 and remains on track to meet CanWEA’s WindVision target of supplying 20 per cent of Canada’s electricity from wind energy by 2025.

At the provincial level, we are now entering a period of discussion across the country where governments will be laying out plans for their power sectors for the period after 2015.

Ontario:

In Ontario, for example, Energy Minister Bob Chiarelli announced May 30 that the feed-in tariff program for projects over 500 kW in size will be replaced with a competitive procurement process. This will only apply to contracts to be awarded in the future, and not to existing FIT contracts. The size, scope and timing of future procurements will be subject to a review of Ontario’s Long-Term Energy Plan (LTEP), taking place over the summer.

British Columbia:

In British Columbia, new resource and LNG development in the north is projected to lead to a significant increase in electricity demand. Whether that is met by wind or natural gas will have major implications for the future of our industry in the province. BC’s May 14 general election returned the Liberals to office with one additional seat, and elected Canada’s first provincial Green Party representative. The results indicate British Columbians strongly favour economic development, but not at the expense of the environment. Given the huge energy demand of proposed industrial development in BC, this sentiment could have a positive impact on the market for wind.

Alberta:

CanWEA released WindVision 2025: A Strategy For Alberta on May 22, calling on the province to implement a Clean Electricity Standard (CES) and raise the carbon price imposed on large emitters to help Alberta wind producers overcome market barriers to new project development.

Quebec:

Premier Pauline Marois announced May 10 that the province will buy another 800 MW of wind in four separate blocks that include utility project development, competitive requests for proposals and a First Nations set-aside. She also said Quebec will develop a new long-term energy strategy that will include additional wind purchases through 2024.

Atlantic Canada:

In Nova Scotia there is a significant public debate about the Maritime Link, an undersea transmission line that will bring power from the first phase of the Lower Churchill hydro project to the province. While CanWEA had hoped that the Maritime Link could enable the development of more wind energy in the province, this now appears unlikely to be the case. As a result, CanWEA is actively participating in the formal review process, arguing that a better and more cost-effective choice for Nova Scotia is one that relies more significantly on wind energy to meet future electricity demand and Nova Scotia’ renewable energy targets.

Is the cost of wind energy infrastructure rising or falling at the current time and what do you expect for the near future?

The cost to build wind energy continues to decline, with dramatic drops over the past three years while significant efficiency gains are being realized in modern technology and siting. While all new sources of electricity generation will cost more than current sources of supply that have been built and paid for decades ago – wind energy is more cost-competitive than new installations of coal with carbon capture and storage, small hydro, and nuclear power.

The wind that turns the turbine blades is free; this means that once a wind farm is built, the price of electricity it produces is set and remains at that level for the entire life of the wind farm. Traditional sources of energy are open to extreme price volatility, so the long-term cost-certainty and stabilizing effect of electricity rates from wind farms provide important protection for consumers. Wind projects also have very short construction periods and can be deployed quickly with significant positive impacts delivered to local communities.

Are there any technological breakthroughs that you see having an effect in the near or distant future?

The technology of a wind turbine is constantly evolving as improvements are made in gearbox and drivetrain efficiencies, direct drive units, power electronics, SCADA Systems, O&M capabilities (e.g., condition monitoring, early fault detection, etc.), resource assessment accuracy and remote sensing technologies (LiDAR, SODAR) to name a few. The blade technology is also getting lighter and stronger which is making turbines even more efficient and quieter.

There are also areas of focus, while not directly related to wind turbines, enable increased uptake in wind energy development. These include:

- storage technologies, both at the wind turbine, wind plant and overall system level. Storage allows wind variability to be strategically managed, as well as enables operators to provide additional ancillary services (e.g., frequency response);

- improvements in radar and detection systems which serve to reduce interference and objections to wind energy developments by organizations like NAV Canada, Environment Canada, DND, private/public broadcasters;

-

improved understanding of bat movements, ensuring continued downward pressure on environmental impacts.

CanWEA has recently announced WindVision 2025: A Strategy for Alberta. Can you please tell us more about it?

CanWEA’s WindVision 2025: A strategy for Alberta demonstrates that Alberta has about 5,000 MW of easily accessible wind resources that can produce energy at a more affordable cost than virtually any other form of electricity generation available today. However, the structure of the province’s current competitive electricity market makes it very difficult for new wind farms to be financeable and to secure the revenues needed to be economically viable.

CanWEA has identified two complementary policies that, if implemented together, have the potential to allow the industry to overcome these barriers. The first and primary measure is implementation of a Clean Electricity Standard and a second supplementary measure is an Increase in carbon price imposed on large emitters under Alberta’s existing Specified Gas Emitters Regulation (SGER), something the province has already acknowledged it needs to do to encourage the investment choices and technology advances that will allow it to meet its climate change targets.

CanWEA believes immediate and real actions to implement WindVision 2025 can help return Alberta to a leadership role in clean renewable energy development and reduce greenhouse gas emissions, all while respecting the province’s commitment to technology neutral, market-based solutions.

The document is available at www.canwea.ca/albertawindvision.

Tell us about CanWEA 2013. Who will be attending and what can delegates expect this year?

CanWEA's 29th Annual Conference and Exhibition will be held October 7-10, 2013 in Toronto, Ontario. This premier wind energy event will bring together over 2,000 experts from all over the world to discuss the opportunities and latest developments in the wind energy industry. The exhibition will feature over 200 exhibiting companies and will provide companies with an exclusive opportunity to network and generate new business leads.

The program features 16 education sessions, running the gamut from project financing to community wind, and three plenary sessions that will take an in-depth look at Canada’s major wind markets, including an all-renewables discussion about Ontario’s long-term energy plans. CanWEA is also introducing a job fair component this year, as well as 75-seat presentation theatre on the show floor where exhibitors will be able to showcase their products or services. This year’s conference will be held at the downtown Metro Toronto Convention Centre (MTCC), within walking distance of the waterfront and other city attractions.

For more information on Canada’s largest wind energy conference, visit: www.canwea2013.ca.

The content & opinions in this article are the author’s and do not necessarily represent the views of AltEnergyMag

Comments (0)

This post does not have any comments. Be the first to leave a comment below.

Featured Product