The key to implementing CHP is to reduce risk by properly addressing the associated risks: technology guarantees, solid operating and maintenance agreements, long-term natural gas contracts and insurance along with creative financing structured to the individual needs of the property.

Combined Heat and Power Project Finance

Larry Thrall | Vireo Energy Finance

The Data Center industry is poised for a boom in the use of combined heat and power systems due the low cost of natural gas and the high and ever increasing cost of electricity. Facilities such as Hotels, Hospitals, campuses, industrial users, prisons, data centers and office buildings are a natural match for CHP due to their high base load demand for energy and the ability to efficiently use the heat generated from these systems by offsetting hot water, heating and air conditioning loads. In addition, CHP technology has become more reliable, remains comparably inexpensive, and creates efficiency. The spark spread is the difference between the cost of burning natural gas for electricity and buying that electricity directly from the grid. In the US it has never been larger and looks to grow. For the purpose of this article, we are addressing CHP systems that can take advantage of this spread.

THE PROBLEM

The principal barrier to the sale of CHP is finding the capital needed for these systems. We estimate that nine of ten potential clients will be limited by their capital budget to purchase a CHP system. So far, the CHP industry has been actively pursuing this well-funded 10% of the market. In addition, most companies have other priorities for their limited capital budgets; CHP is usually not on their priority list. As a result they are most likely not aware of the financial options when purchasing CHP. Last, these systems come with other risks such as gas price risk, operations and maintenance costs, and equipment failure risk.

THE SOLUTION

What can we learn from the solar industry? The solar business developed very quickly over the last three years into one of the fastest growing industries in the country. This happened in part due to market conditions, tax incentives, rebates, lower costs etc… But the primary mover was the ability of the financial sector to quickly develop products that could wrap all of these benefits up into a tight little package called a power purchase agreement (PPA) which is how traditional utility energy projects have been financed for years.

The power purchase agreement opened the door to finance these capital intensive projects over a larger portion of their useful life. Innovators in the solar industry realized that they could structure smaller commercial and residential installations in the same way.

The solar PPA was born and has been one of the primary reasons for the immense growth in the solar industry. The solar PPA offers the end user the ability to buy solar power with little technology or finance risk. It is off-balance sheet, which allows finance companies to monetize the tax incentives and rebates while passing along some of these benefits to the customer in the form of a lower cost of energy.

Solar projects with paybacks of 7–12 years and useful lives of 25+ years are financed over 15–20 years. The investors are given an above market return and the customers are given a lower cost of electricity; everybody wins. The majority of solar customers would not have bought solar without this structure.

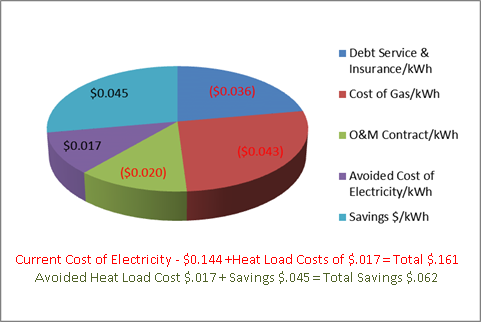

Figure 1 CHP - Cost Benefit Breakdown

PPA CONTRACTS AND OPERATING LEASES FOR CHP

The CHP industry is adapting this same strategy and some groups now offer PPA or off-balance sheet finance to its customers in order to compete. The customer needs to be convinced that they are not buying hardware, but instead buying a lower cost of energy. Inherently, CHP has different risks associated with it. These risks need to be addressed and assembled into a nice little package for the customer.

Technology risk

Whether it is a fuel cell, internal combustion engine or turbine, they all a have technology risk. Performance guarantees are usually offered by the manufacturers on their products that help ensure the production on heat and electricity on projects. For smaller and/or newer technology providers, additional insurance may be available to cover default on any performance guarantees that may be offered.

Natural gas contracts

The risk of natural gas prices during the life of the contract needs to be mitigated. Long-term natural gas contracts can be secured to match the term of the finance offered. Below are a few options for natural gas contracts:

- Flat rate contract – pay the same price for the life of the contract. The initial contract price will be above current market prices. The flat rate passes on more benefit towards the end of the contract when prices are more likely to have risen when compared to current prices.

- Escalating price contract – start with a base rate, and increase it over the life of the contract. This allows the customer to know what they will be paying and pay closer to market prices at the start of the contract. Usually the escalator is set at or below the projected escalated price of competing electricity prices.

- Floating rate with collar – The price will fluctuate with the market, but a ceiling is set for the price during the life of the contract. This allows the client to benefit from the potential lower market prices while paying a premium to hedge their ultimate risk of paying a price above a certain level.

O&M contracts

The customer wants to pay for electricity and heat, not equipment that may or may not work. Operations and maintenance (O&M) agreements help provide service and performance guarantees in order to lower these risks. O&M contracts should be full service, helping guarantee risk of down time. These contracts also help reduce the burden of such tasks from onsite facilities staff. The O&M contracts should match the term of the finance offered.

FINANCE

There are a few choices when it comes to paying for these systems; capital leases, operating leases or PPAs, see Table 1. The longer the term of the loan, the better the initial cash flow the project will have.

The current market supports up to 10 year tenures on operating leases and PPAs. For projects over 10 MW, structured finance is available matching equity or tax equity investors with debt. Credit is still not easy to obtain, but more lenders are now interested in lending into the Data Center industry. Ideally the client needs to have shown profit for two of the last three years, in addition to having a strong balance sheet. Debt service coverage ratio is expected to be at or above 1.25:1.

Rates for operating leases can be as low as 2% on a 10 year operating lease. This includes the 10% US investment tax credit (ITC) that is given to the bank. Certain lenders are more comfortable with certain industries, so finding the right person at the right bank is important to finding the best deal.

Vireo Energy Finance specializes in energy related finance that can help to secure the best possible finance for a certain type of client.

IN SUMMARY

The key to implementing CHP is to reduce risk by properly addressing the associated risks: technology guarantees, solid operating and maintenance agreements, long-term natural gas contracts and insurance along with creative financing structured to the individual needs of the property.

Table 1 - CHP - Cogen Finance Options

|

Types of finance - |

|

|

Capital lease |

On- balance sheet finance. The customer will retain the ITC and depreciation. This works best for corporate clients that have income to shelter. Corporate clients may have income to shelter, but still want off balance sheet finance in order to use their capital budget for other items that are of a higher priority. Rates are from 4% – 8% depending on size of transaction, term and credit risk. |

|

Operating lease |

Off-balance sheet finance. This offers the ability for the customer to implement capital intensive changes without having to impact their balance sheet. Nine out of 10 customers choose off balance sheet finance. Rates are from 1% – 4% depending on size of transaction, term and credit risk. |

|

PSA – power service agreement |

The power service agreement is a package of all of the items below. The PSA has the lowest finance costs, but slightly more risk than a PPA. Typically, the customer will contract for 10 years to rent the equipment, which will be guaranteed to produce a certain amount of power at a certain price. The rates for the operating lease are much less (1% – 4%). |

|

This includes: |

|

|

10 year manufacturer's performance guarantee |

|

|

10 year operations and maintenance agreement |

|

|

10 year natural gas contract (flat, floating with collar, escalator) |

|

|

10 year operating lease |

|

|

10 year full wrap backstop insurance policy (optional). |

|

|

PPA – power purchase agreement |

The power purchase agreement is an off-balance sheet transaction in which the buyer agrees to buy all of the power and heat that the CHP system will produce at an agreed upon rate. Because there is more risk to the investor, the PPA costs more, taking a significant portion of the savings from the seller. |

Larry Thrall is the Managing Director of Vireo Energy Finance, Malibu, California, USA. Vireo Energy Finance specializes in energy related finance.

The content & opinions in this article are the author’s and do not necessarily represent the views of AltEnergyMag

Comments (0)

This post does not have any comments. Be the first to leave a comment below.

Featured Product