Our strategy is focused on being close to the market. For the last 25 years the photovoltaic sector has operated mainly in a horizontal fashion. Now the time for vertical integration has come, and we are well positioned for this change. With this in mind, the recent joint venture Espe-SunParc will allow Silfab to be completely involved in every segment of the downstream market, including Solar Farms.

Franco Traverso | Silfab SpA

1. Silfab recently opened a manufacturing plant in Ontario: What is your current capacity and workforce?

I am very proud of what we have accomplished so far in Ontario. In June 2010, Silfab launced a new ambitious project: building a highly automated production site in Ontario (Canada). The planned production capacity we initially thought of was 120 MW, to be reached in two stages: 60 MW to be completed by the second quarter of 2011, and the remaining 60 MW to be added by the end of 2012. Later, we brought our targets to 90 and 180 MW, as demand in Ontario is growing.

I am very proud of what we have accomplished so far in Ontario. In June 2010, Silfab launced a new ambitious project: building a highly automated production site in Ontario (Canada). The planned production capacity we initially thought of was 120 MW, to be reached in two stages: 60 MW to be completed by the second quarter of 2011, and the remaining 60 MW to be added by the end of 2012. Later, we brought our targets to 90 and 180 MW, as demand in Ontario is growing.2. Why did you choose Ontario for this plant?

3. What are you plans in the near future, for capacity and workforce?

4. What are some of the differences you found in running a manufacturing plant in Ontario, as compared to Italy ?

5. What are Silfab's top products currently on the market, and what new products can we expect to see soon ?

6. About your recently announced “Zebra” IBC cell: what have you already achieved, and what do you forecast for its future development ?

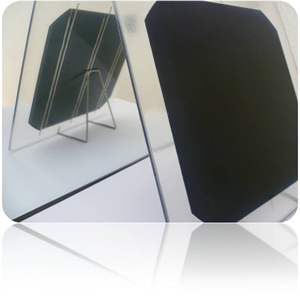

Zebra is a new interdigitated back-contact solar cell with actual 19+% energy conversion efficiency and potential exceeding 22%, and that uses a low-cost industrial process. The Zebra cell concept is based on large area (156 mm x 156 mm) n-type monocrystalline (Cz) silicon wafers and is a back-contact, back-junction cell without any metallization on the sunny side. In our first trials on large wafers (156 mm x 156 mm) we have already achieved a conversion efficiency of 19+ %. This means that, while the efficiency of today’s industrial mainstream monocrystalline cell technology will soon saturate at around 19-20%, Silfab’s innovative Zebra technology starts at 19%, and can reach efficiencies of over 22% while significantly reducing the production costs per Watt peak.

Zebra is a new interdigitated back-contact solar cell with actual 19+% energy conversion efficiency and potential exceeding 22%, and that uses a low-cost industrial process. The Zebra cell concept is based on large area (156 mm x 156 mm) n-type monocrystalline (Cz) silicon wafers and is a back-contact, back-junction cell without any metallization on the sunny side. In our first trials on large wafers (156 mm x 156 mm) we have already achieved a conversion efficiency of 19+ %. This means that, while the efficiency of today’s industrial mainstream monocrystalline cell technology will soon saturate at around 19-20%, Silfab’s innovative Zebra technology starts at 19%, and can reach efficiencies of over 22% while significantly reducing the production costs per Watt peak.7. How are you involved in the research of new modules technology?

8. Do you expect to see any major breakthroughs in PV technology in the near future?

9. Can you tell us more about your business development fields and strategies?

10. What are your thoughts about the global future of PV?

Our analysis of a 1 MW solar farm in Italy shows us the following results: over the 20 year long "financial life" of the plant the cumulated cost of capital and taxes is 56% of the revenues. The cost of BoS, permitting and manufacturing, maintenance, insurance and administration accounts for 30%. And finally, the cost of the actual solar farm, its photovoltaic panels and equipment, represents only 14%.

Western companies must take further steps towards vertical integration in order to reduce the "full cost" and achieve the Grid-Parity. The next frontier!

Franco Traverso

Franco Traverso, Silfab’s President and founding partner, is a pioneer of Italian photovoltaic technologies with 30 years of experience in the solar energy industry.

In 1981, Mr. Traverso established Helios Technology Srl spearheading a unique path in PV breakthrough; as Helios’ CEO, he developed a robust technology platform and several important international patents. In addition, he developed small and large PV systems, launched a production line of CZ ingots and wafers, and performed technology transfers in India, Sweden and South Africa.

In the early 90’s, he started a joint-venture with a Russian company and founded a silicon wafer production company, Solaris d.o.o., in Croatia.

With the creation of Silfab in 2007, Traverso opened a new chapter dedicated to developing an integrated supply chain based on a ‘green-to-green’ business model, installing a wide network of new generation high-efficiency solar farm and launching new high-performing PV mono and multi-crystalline modules with a power up to 300 Wp. Last summer (2010), he founded the subsidiary Silfab Ontario Inc., a Canadian-based modules manufacturing company with an annual production capability slated to reach 180 MW.

The content & opinions in this article are the author’s and do not necessarily represent the views of AltEnergyMag

Comments (0)

This post does not have any comments. Be the first to leave a comment below.