An Economic Case Study in Energy Financing

Coal Plants in Transition Study

Paul Sheldon | Natural Capitalism Solutions

Coal-burning power plants in the United States are periodically subject to a number of internal and external processes that present utilities and power producers with the opportunity to evaluate a range of options for how a plant fits into a company’s overall business plan. Internally, these can take the form of things like resource planning, equipment testing, ongoing operational evaluations, or financial reviews. Externally, they can come in the form of activities such as re-permitting, compliance inspections, or regulatory changes that may require, for example, upgrades in order to meet new pollution limitations or a change in generation resources to meet renewable energy standards.

In deciding the soundest business path at such junctures, utilities and other power producers may consider a number of questions. For example: Are technological upgrades required to comply with new emissions, water quality or waste disposal laws? Will adding technological advancements improve performance? If so, would the financial benefits of increased performance outweigh the costs? How near is the plant or specific equipment to the end of its operational life? How will different options affect the reliability of electric generation?

The Coal Plants in Transition report provides a “proof of concept” approach regarding potential scenarios under which a utility or electricity provider might find it cost-effective to transition jobs and energy services from an existing coal plant towards options that present alternative jobs and profit streams. As such, the authors have also developed a “Utility Dashboard Calculator” – available online at www.natcapsolutions.org/coal/calculator.xls – that allows utility managers to input data to see firsthand how different scenarios might play out.

Because this is a broad conceptual analysis, no attempt has been made to describe net present values, annual dollars, levelized costs, nominal costs, or any of the other more complex economic calculations that would be required to apply these options to a specific coal plant. Similarly, other than an illustrative, hypothetical example in the electronic Dashboard Calculator, this report does not include analysis of operational specifics such as load capacity, spinning reserves, time of day, and/or demand profiles that would be required to match efficiency improvements and renewable sources of supply to the particular profile of an individual power plant.

Nor does it calculate specific related but peripheral issues such as health impacts arising from emissions, fuel price volatility or externalities such as the environmental impacts of coal mining, extraction, and transport. There are brief discussions of these issues as potential ancillary benefits to transitioning from coal to cleaner energy sources, but the indirect financial impacts are not included in calculations on which study conclusions are based.

Report Highlights

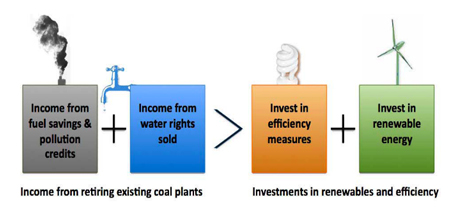

By combining sizable revenue streams from pollution credits and water rights, with fuel-savings and • revenue from “green” electricity sales, it’s possible to make a strong business case for utilities to transition their resource mix from fossil fuels to efficient use of renewable technologies. When the values of fuel savings, carbon-, sulfur-, and other market credits and “green electricity” premium prices, plus the value of water rights obtained by transitioning from coal to less water-intensive energy sources exceeds the investment that would be required to increase efficiency and provide renewable energy sources, then it will be profitable to make the transition from coal and other fossil fuels to efficient use of renewable energy.

To demonstrate the sufficiency of this approach and the potential profitability of transitioning existing coal generation resources to increased efficiency and renewable energy supplies, the authors have applied the concepts in this analysis to a case study of the 35-year old Navajo Generating Station (NGS), a 2,250- megawatt coal-fired power plant located near Page, Arizona. The plant provides electricity to five major public and commercial utilities in Arizona, California, and Nevada, although the largest percentage of its electricity is purchased by the U.S. Bureau of Reclamation to provide power to pump water through the Central Arizona Project’s 336-mile network of canals. The operators of NGS are facing the prospect of having to install new scrubbers in order to comply with EPA air quality requirements. Cost estimates for this new equipment range from $38 million to nearly $100 million annually. Other factors potentially affecting future operations at NGS include potential carbon limitations and the fact that the city of Los Angeles has decided not to renew its contract for electricity from NGS when it expires in 2019.

The Coal Plants in Transition study considers three scenarios – low, medium, and high – to estimate the value of pollution and carbon credits, water rights revenue, fuel savings and “green” power revenues. Applying the average or “medium” values to these variables, the authors calculated that generating capacity from NGS could profitably be replaced through efficient programs and the use of renewable energy. By doing so, the operators would realize an estimated revenue surplus of $157.6 million annually.

Potential revenue includes:

- Sales of NGS rights to more than 34,000 acre-feet of water, yielding between $3.4 million and $36.8 million annually, depending on the price per acre-foot. Under the average or medium scenario, water sales are modeled at $630 per acre-foot, although it is quite possible that prices would be much higher in the NGS service territory. The price for water in some urban markets in Texas, for example, is hitting $1000 per acre-foot or higher.

- Pollution credits for sulfur and nitrogen oxide emissions, which would generate up to $14.1 million and $26.8 million per year, respectively, although historical market swings for these pollutants have driven price fluctuations by an order of magnitude or more.

- Fuel cost savings of up to $830 million annually.

- Potential revenue of up to $1 billion per year from trading credits for the more than 19 million tons of CO2 emitted annually by NGS. Current carbon trading regimes are either voluntary or regional. Since Arizona, where NGS is located does not yet have either legislation to restrict CO2 emissions or a mandatory market for trading them, values are based on projected prices from markets in Europe, the northeastern United States and California, including projections by the U.S. Energy Information Administration that fall well within forecasts used by a number of utilities in their business modeling. Under this model, when carbon hits a modest price of $35 per ton, the scenarios used in the study become cost effective.

Projections for the cost of required investments in renewable energy and efficiency technologies to replace output are modeled to match a generation profile similar to NGS. These include a full range of technologies: wind, photovoltaic solar, concentrating solar, geothermal, and biomass (where appropriate), which can be scaled appropriately using the accompanying dashboard calculator, depending on available resources under different scenarios. Potential costs of installing or acquiring this capacity vary from $757 million to around $1.6 billion.

Although it is outside the scope of the Coal Plants in Transition study and not quantified in the model, another issue that may factor into financial decisions related to generation capacity is job creation and retention. As documented in the study, a number of analyses over the past several years, in California, Colorado, Kentucky and nationwide, have found that investing in clean-energy alternatives has resulted in significant job creation and economic development. For example, California’s investments in energy efficiency have created more than 1.5 million new jobs and $65 billion worth of household energy savings in the last 30 years.

The content & opinions in this article are the author’s and do not necessarily represent the views of AltEnergyMag

Comments (0)

This post does not have any comments. Be the first to leave a comment below.

Featured Product

Canadian Solar - HiKuBlack - Black Backsheet & Frame (Mono)

Aesthetic appearance for residential systems: With black backsheet & black frame, Power range 380 ~ 405 W, Low power loss in cell connection. Enhanced reliability: · Low temperature coefficient (Pmax): -0.34 % / °C, LID LeTID less than 2.0%, Lower hot spot temperature, Better shading tolerance.